The Cooperative (Osunmayegun Women in Agriculture)

Osunmayegun Women in Agriculture is a group established and registered in 2013 as a Cooperative society. The 12 members of the Cooperative comprise of farmers and civil servants from the same community, who provided their land for cultivation of cassava. The main business of the Cooperative is cultivation and processing of cassava into garri and cassava flour. The cassava flour is a new product being experimented with due to the saturation of the regional garri market. Until one of the members of the cooperative society participated in the SME Loop, the activities of the Cooperative were being financed by personal contributions from members, which impeded growth.

The main business vision of the cooperative is to start exporting to the foreign market, as the local market is already saturated. Currently, they lack NAFDAC certification and thus cannot aim for the export market. Alhaja Rasikatu Olusesan Adenokun, a member of the Cooperativeparticipated in the 2017 SME Loop.

The Impact of the SME Loop

Major changes achieved as a result ofthe SME Loop:

- Participating in the SME Loop helped the Cooperative realise the need to maintain an active account. Hence, their bank account was reactivated after over five years of being dormant. This enabled the cooperative to pitch during the B2B event

- From the knowledge gained during the SME Loop training and coaching, they were able to document records of their operations properly, which is a mandatory requirement to access a loan from any financial institution.

- They pitched their business plan during the B2B event. Following up on their pitch, they received a loan of N1,500,000 for the 10 registered members. The loan was invested in farming cassava and procurement of processing machines, which are necessary for NAFDAC certification. They were able to meet with NAFDAC during the training and learnt what they need to put in place before NAFDAC can be invited to initiate the registration process.

- Peer-learning : The SME Loop also created an opportunity for networking and inspiration amongst the participants. One of the participants that influenced the Cooperative was Olusegun Isijola, the CEO of Visafin Nigeria Limited. Visafin is into rice farming and processing. He suggested to the Cooperative to also engage in irrigated rice farming, since this wouldn’t interfere with what they are already doing, but complement it.

- Through the Federal Government’s Anchor Borrower Scheme, they have been provided with farm input for irrigated rice farming, such as a pumping machine, seeds, and fertilizer.

Impact in Figures

- Income was 117% increase from Baseline

- The cooperative pitched during the B2B event and got a loan of N1,5000,000 for the 10 registered members

The SME Loop

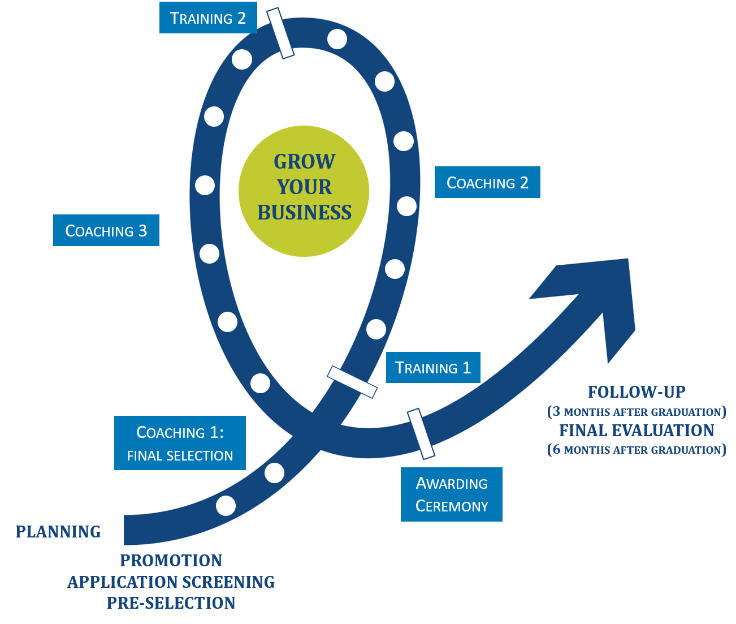

The SME Business Training and Coaching Loop (SME Loop) is a combined approach of basic and advanced entrepreneurship trainings and individually tailored business coaching, spanning over a 6 months period. The SME Loop approach was developed by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH in Sierra Leone and further enhanced by GIZ in Benin Republic. It was conceptualised as a mix of tools from various institutions including the Financial Literacy Toolkit from GIZ Nigeria. In Nigeria, the Pro-Poor Growth and Promotion of Employment in Nigeria Programme – SEDIN, implemented by GIZ and funded by the German Federal Ministry for Economic Cooperation and Development (BMZ), aims to foster employment and increase income of MSMEs. This is done through financial systems development as well as private sector development. In April 2017, SEDIN started to adapt and apply the SME Loop approach with a thorough application process and a total of 252 enterprises (about 30% headed by women) certified in 2018 for successful completion of the SME Loop.

“We were very impressed with the way the Cooperative documented its business transactions. Apart from reviewing their business records, we met with the Cooperative for some time and established a strong relation before we considered them qualified for the loan. One other factor that favoured the Cooperative regarding access to the loan was having 20 percentage of the requested loan amount deposited in in its account with our bank.”

Statement by Mr. Badawo, Head of Credit Unit, Bank of Agriculture, Ago-Iwoye branch